haven't paid taxes in years uk

As part of the UKs 202021 tax year 6th April 2020 to 5th April 2021 dividend allowance is 2000 per year. For the self employed in 1415 that was 275 per week class 2 and 9 class 4 on profits over 7956 so again assuming you had zero costs that would be 143 class 2 plus.

American Expat Tax In United Kingdom Expat Tax Online

Havent paid taxes in 2 years.

. The IRS recognizes several crimes related to evading the assessment and payment of taxes. Thats My Boy 2012 clip with quote - Three years. You dont always have tax to pay it really depends if your income was above a certain amount.

Before he became a near household name Anthony Bourdain had tax problems. This means that if they become aware of an underpayment. Failure to file or failure to pay tax could also be a crime.

Earnings from 8000 up to 20000 within five years flat thereafter. Under the Internal Revenue Code 7201. High School or GED.

The latest you can register is by 5 October after the end of the tax year. For more than 10 years the well-known chef author and television host failed to pay his taxes. The failure to file penalty also known as the delinquency penalty runs at a severe rate of 5 up to a maximum rate of 25 per month or partial month of lateness.

03000 530 310 In 2020 alone Nike recorded pre-tax income of 29 billion yet it paid no federal income tax the analysis found. Thank you - Answered by a verified UK Tax Professional. As the title states I never filled taxes.

If you do not usually send a tax return you can register for Self Assessment to declare any income you have not paid tax on from the last 4 years. I am a 25 year old whose been a 1099 realtor since 2018. This means that if they become aware of an underpayment.

First year I made next to nothing and was living. Here are the three taxes to look out for. Before May 17th 2022 you will receive tax refunds for the.

Ad Need help with Back Taxes. As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late. What Happens If You DonT File Taxes For 5 Years Uk.

I havent been earning any money elsewhere and have been pay taxes via my full time PAYE job for the past 5 years. My gross wages are 4500 a month and 575 a month car allowanceI. Once you have received advice the non-disclosure or.

Not paid tax for 10 years. Up to 15 cash back Its best if you register with HMRC as soon as your circumstances change. Up to 15 cash back Accountant.

This is because the CRA charges penalties for filing and paying taxes late. Income Tax if you earn less than. If you are convicted of an income tax.

An HMRC officer will then visit you between 6am and 9pm if you live in. First get your records together ie income expenditure. In England and Wales we will first issue you with a formal Notice of Enforcement that will cost you 75.

I havent paid taxes in 5 years uk Wednesday June 1 2022 Edit. Failure to send in a tax return that has been requested will result in HMRC writing applying penalties estimating your income your tax and applying further penalties and. After May 17th you will.

Youll need to fill in a separate tax return for.

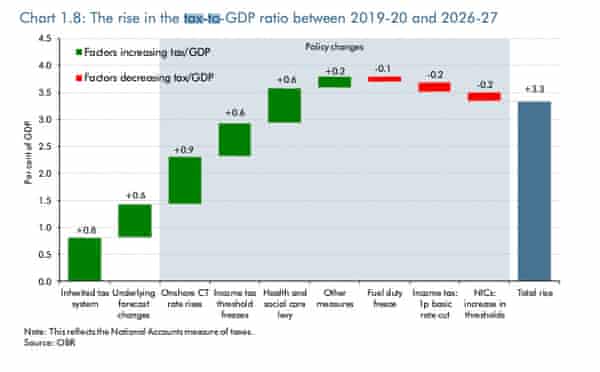

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

Brexit What You Need To Know About The Uk Leaving The Eu Bbc News

Irs Tax Tracker How Long Does It Take For Irs To Approve Refund Marca

Six Companies That Avoid Paying Their Taxes Real Business

Here S What Happens If You Don T File Your Taxes Bankrate

20 Things To Know About U S Taxes For Expats H R Block

Big Companies Like Fedex And Nike Paid No Federal Taxes The New York Times

How To Write Off Unpaid Invoices And Protect Your Finances Ff Blog

Nearly Half Of Adults Don T Pay Income Tax Hmrc Data Shows The Sun

Taxes In Spain For Expats All The Taxes You Will Need To Pay

What Is The Penalty For Failure To File Taxes Nerdwallet

I Haven T Filed Taxes In 5 Years How Do I Start

Here S What Happens When You Don T File Taxes

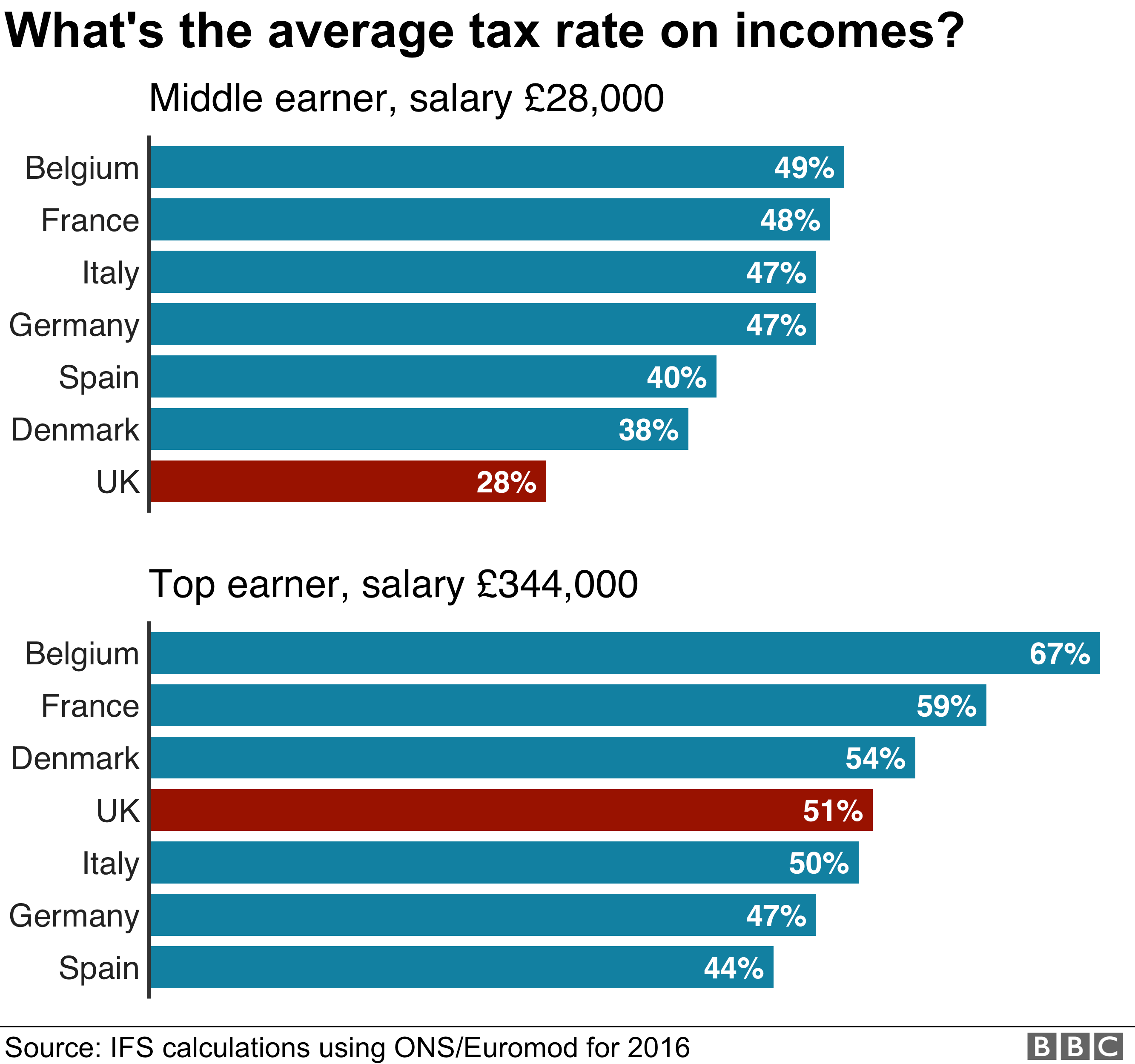

General Election 2019 How Much Tax Do British People Pay Bbc News

Google Says It Will No Longer Use Double Irish Dutch Sandwich Tax Loophole Alphabet The Guardian

How Does Hmrc Know About Undeclared Income That You Have Not Paid Tax On Freshbooks

Us Citizens Living Abroad Do You Have To Pay Taxes

Why Am I Paying Tax If I Haven T Earned My Tax Free Allowance Yet Caseron Cloud Accounting