tax shield formula uk

Depreciation Tax Shield 2 million 16 million 400k. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m.

The tax shield Johnson Industries Inc.

. Or the concept may be applicable but have less impact if accelerated depreciation is not allowed. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. The maximum depreciation expense it can write off this year is 25000.

Taxes 8 million 20 16 million. Finch House 2830 Wolverhampton Street Dudley West Midlands DY1 1DB. Taxshield is a trading name of Shield Products Limited.

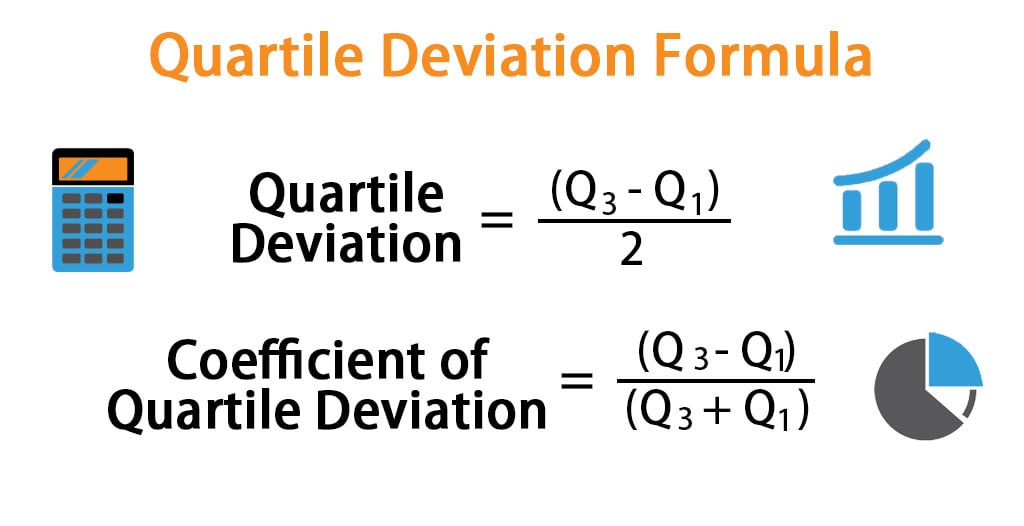

It is because 400 has already been saved or there is 400 less cash flow due to the tax shield. Thus a tax shield is an amount by which the depreciation and amortization or any non-cash charge lower your income subject to taxation creating cash savings. Tax Shield formula.

It also has an option to write off only a minimum amount of 2700. It is important to have the depreciation numbers along with the income tax rate of the entity being calculated. Any expense that lowers ie.

The product of the depreciation and income tax numbers is. Cash Flow and thus directly impacts Valuation. There are two simple steps to calculate the Depreciation Tax Shield of a company or individual.

The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. The Tax Shield approach minimizes the tax bills for the taxpayer. The applicable tax rate is 37.

If we do not convert the bond the tax savings would be 400. Tax Shield Deduction x Tax Rate. Else this figure would be less by 2400 800030 tax rate as only depreciation would remain the deductible expenses.

The effect of a tax shield can be determined using a formula. You calculate depreciation tax shield by taking 100000 X 20 20000. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction.

Interest Tax Shield Example. Tax and accounts software for accountants tax specialists SMEs and business owners. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

This is usually the deduction multiplied by the tax rate. Tax Shield 10000 40 100 Tax Shield 4000. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income.

To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give you 3500. Tax Shield 8000 45000 30 15900 So the total tax shied or tax savings available to the company will be 15900 if it purchases the asset through a financing arrangement. The Interest Tax Shield is similar to the Depreciation.

In Scenario B the taxes recorded for book purposes is 400k lower than under Scenario A reflecting the depreciation tax shield. But if we avail the option to convert the bond the net value of lost tax shield is 2000 1 20 1600. 1 Since a tax shield is a way to save cash flows it increases the value of the business and it is an important aspect.

The Depreciation Tax Shield reflects the Tax Savings from the Depreciation Expense deduction. Tax Shield Amount of tax-deductible expense x Tax rate. The Depreciation Tax shield directly affects Income Taxes paid ie.

For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the tax shield approach will be worth 200. Tax Shield Value of Tax-Deductible Expense x Tax Rate. Shields taxes paid is a Tax Shield.

Tax Returns UK Property Foreign and more Partnership Tax Manager takes care of everything you need to submit your Partnership Tax return quickly and easily in time for the filing deadline. 1 For example because interest on debt is a tax-deductible expense taking on debt creates a tax shield. In this case straight-line depreciation is used to calculate the amount of allowable depreciation.

Tax Rate 40Tax Shield Sum of Tax Deductible Expenses Tax rate. Will receive as a result of a reduction in its income would equal 25000 multiplied by 37 or 9250. Once these numbers are found you multiply depreciation by the income tax rate.

Conversely the lower your depreciation expense the lower your tax shield. To learn more launch our free accounting and finance courses. Interest Tax Shield Interest Expense Tax Rate.

Example of the. Calculating the tax shield can be simplified by using this formula. Therefore the company can achieve a tax shield of 20000 by leveraging its depreciation expenses.

Net Income 8 million 16 million 64 million. The higher your depreciation expense the higher your tax shield. Sum of Tax Deductible Expenses 10000.

The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. You can create a free account by entering your details here so you can make purchases try our free trials and more.

Pdf Tax Rate And Non Debt Tax Shield

Quartile Deviation Formula Calculator Examples With Excel Template

Weighted Average Cost Of Capital Wacc Formula Calculation Example

Taxable Income Formula Calculator Examples With Excel Template

Effective Interest Rate Formula Calculator With Excel Template

Loss Ratio Formula Calculator Example With Excel Template

Annual Percentage Rate Apr Formula And Calculator

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Discounted Cash Flow Dcf Valuation Investment Guide

Native Remedies Sweat Less Natural Homeopathic Formula For Excessive Sweating 810845017336 Ebay Native Remedies Excessive Sweating Homeopathic

Salvage Value Formula Calculator Excel Template

Reserve Ratio Formula Calculator Example With Excel Template

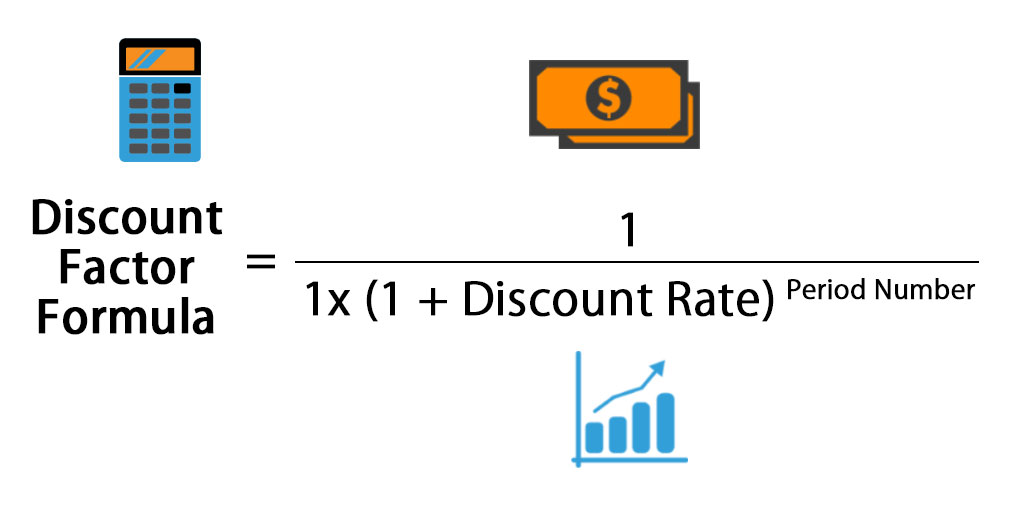

Discount Factor Formula Calculator Excel Template

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs

Compute The Present Value Of Interest Tax Shields Gene Itprospt

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)